Hello, I’m Torkey, and I invest in stocks as a hobby.

In the Japanese stock market of 2024, the investment environment appears to be highly favorable, considering technical factors, interest rates, exchange rates, and corporate performance.

This is evident in the significant overbought conditions of Japanese stocks, driven by the movements of well-capitalized foreign investors.

In other words, it’s a fantastic opportunity for Japanese stocks right now.

In this article, I will explain why Japanese stocks are in demand and share seven advantages of investing in them.

Whether you are already interested in Japanese stock investments or just curious, this content is a must-read.

Please stay tuned until the end.

- 【7 advantages of Investing in Japanese Stocks】

- ① Technical Aspect | Strong Nikkei Stock Average

- ② Interest Rate Perspective | Continuation of Monetary Easing

- ③ Foreign Exchange Aspect | Three Consecutive Record Profits Due to Weakening Yen

- ④ Corporate Performance Perspective | Initiatives to Increase PBR

- ⑤ Economic Perspective | Economic Recovery Through Inbound Tourism

- ⑥ Economic Perspective | Escaping Prolonged Deflation

- ⑦ Miscellaneous | Buffett Effect

- 【Japanese Stock Sector Rotation | Leveraging the 7 Advantages of Investing in Japanese Stocks】

- 【Summary】

【7 advantages of Investing in Japanese Stocks】

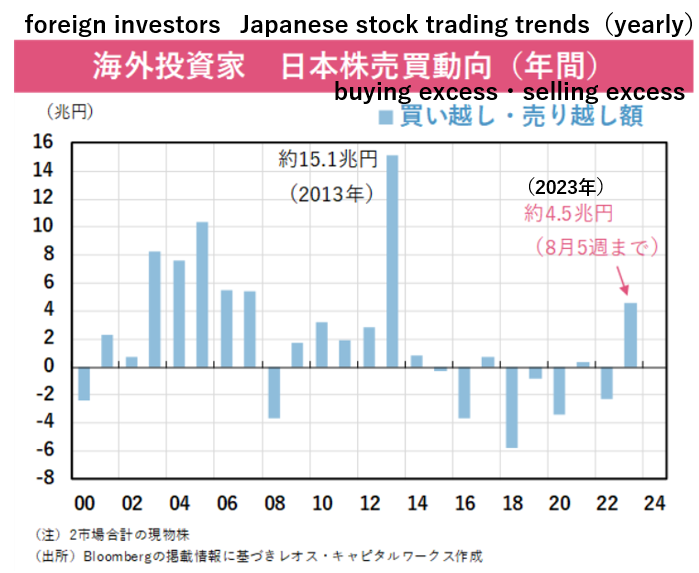

Currently, foreign investors are buying Japanese stocks.

In the first year of Abenomics in 2013, foreign investors bought over 15 trillion yen worth of Japanese stocks, but over the past 10 years, they have generally been net sellers. However, in 2023, by August, they had already significantly bought over 4.5 trillion yen.

So why are foreign investors buying Japanese stocks now?

Let’s delve into a detailed explanation of the seven advantages of investing in Japanese stocks.

① Technical Aspect | Strong Nikkei Stock Average

As of the end of December 2023, Japanese stocks have been trading at their highest levels in 33 years since the collapse of the bubble economy in March 1990.

December 29, 1989| Reaching an all-time high at 38,915.87 yen.

March 10, 2009| Hitting the lowest point since the burst of the bubble at 7,054.98 yen.

December 29, 2023| Currently standing at 33,464.17 yen.

In terms of technical analysis, the Nikkei Stock Average surpassed the resistance line at 30,000 yen in May 2023 and is currently hovering around the high range of 33,000 yen.

The Nikkei Average has experienced a 28% increase over the course of 2023, marking one of the most notable gains globally.

Presently, Japan’s stock market stands out as one of the most captivating markets worldwide.

② Interest Rate Perspective | Continuation of Monetary Easing

In stock investments, the interest rate trends of a country play a crucial role.

Since April 2023, there has been a change in leadership at the Bank of Japan, with Governor Kuroda being succeeded by Governor Ueda. Similar to Governor Kuroda, Governor Ueda has also expressed a commitment to maintaining monetary easing.

Given the seesaw relationship between interest rates and stock prices, if a low-interest-rate policy continues through monetary easing, it creates a favorable environment for stock prices to rise.

From an interest rate perspective, it is anticipated that the Japanese stock market will continue to experience favorable investment conditions for some time to come.

③ Foreign Exchange Aspect | Three Consecutive Record Profits Due to Weakening Yen

Companies that hold significant positions in the Nikkei Stock Average tend to be those benefiting from a weaker yen, as they generate profits through exports.

In other words, the Nikkei Stock Average has a tendency to rise with a weaker yen.

Looking at USD/JPY, it was 110 yen in 2021, but in 2023, a powerful trend of yen depreciation occurred, with the exchange rate reaching 151 yen.

According to the calculations by SMBC Nikko Securities, the net profits of companies are expected to reach a record high for the third consecutive term, as announced in the interim results for September 2023.

Against the backdrop of a weaker yen, Japanese companies find themselves in an environment conducive to increased profitability, driven by factors such as widespread price increases and the recovery of inbound tourism.

The challenge ahead lies in whether these earned profits can be effectively utilized for corporate growth, shaping valuable and sustainable enterprises in the future.

④ Corporate Performance Perspective | Initiatives to Increase PBR

As of the end of June 2023, approximately half of the listed companies in Japan have a PBR (Price-to-Book Ratio) below 1.

This suggests that the stock prices of these companies are undervalued in relation to their net assets.

In essence, half of Japan’s listed companies are perceived as “unattractive” or “unpopular.”

In response, the Tokyo Stock Exchange requested improvement measures from all listed companies, particularly those with PBR below 1, in March 2023.

In other words, they urged companies to “increase their PBR.”

To elevate PBR, companies need to either “enhance their attractiveness and popularity to boost stock prices” or “reduce net assets through increased dividends or share buybacks for shareholder returns.”

Following this request, the number of companies mentioning PBR in their medium-term management plans, announced from January to early June 2023, increased 4.6 times compared to the previous year.

This indicates that there is a significant shift in corporate mindset.

If initiatives such as “improving profit margins,” “undertaking actions contributing to corporate growth,” “increasing dividends,” and “share buybacks” continue to be actively pursued, the future of the Japanese stock market looks promising.

A recent positive development is highlighted in a June 9, 2023 article by Nikkei, reporting an expected record-breaking total estimated dividend amount of 15.2 trillion yen for the fiscal year ending March 2024, marking the third consecutive year of reaching a new high.

⑤ Economic Perspective | Economic Recovery Through Inbound Tourism

When the economic conditions in Japan improve, it positively impacts corporate performance, creating a favorable environment for the Japanese stock market.

One significant factor contributing to the current economic recovery in Japan is the influence of inbound tourism, leading to expanded consumption.

One key driver of Japan’s economic recovery is the impact of inbound tourism, particularly the expansion of consumption.

Since May 2023, when the legal classification of COVID-19 was downgraded from Category 2 to Category 5, Japan has actively welcomed foreign tourists.

In the first half of 2023, the number of foreign tourists reached 10.71 million. Considering that in 2019, before the COVID-19 pandemic, the number was 31.88 million, there is still significant potential for growth.

Moreover, as part of the government’s policy, there is an ambitious target to welcome 60 million foreign tourists by 2030.

With a national commitment to becoming a tourism-oriented country, the expectation is that the economic recovery through inbound tourism will continue in the coming years.

⑥ Economic Perspective | Escaping Prolonged Deflation

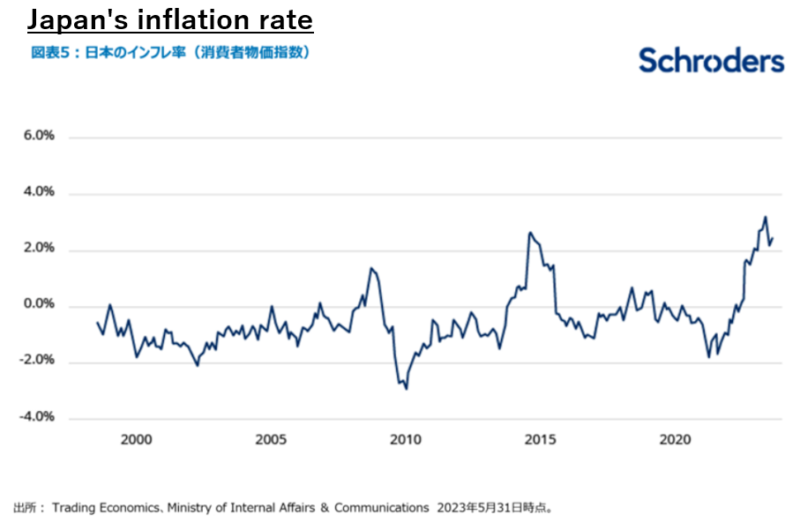

After grappling with deflation for the past 30 years, Japan is finally heading towards inflation.

The current mild inflation raises expectations for a sustained period of increased corporate investment, rising wages, and subsequently, expanded consumer spending.

However, it’s essential to note that this inflation is not purely a result of a positive economic cycle.

It also has negative aspects, such as cost-push inflation due to the surge in import prices caused by a weaker yen and shortages in the supply chain associated with conflicts.

This inflationary period is not a cause for unbridled celebration, as it doesn’t entirely stem from a positive economic cycle.

Nevertheless, it marks a significant transformation in breaking free from the deflationary environment of the past 30 years.

In a Japan where deflation is coming to an end and inflation is taking hold, there is a growing inclination towards investing from cash to assets like stocks.

⑦ Miscellaneous | Buffett Effect

There is a phenomenon in the Japanese stock market known as the “Buffett Effect.”

This refers to the trend where, after renowned investor Warren Buffett takes some action in Japan, the overall market tends to rise for several months.

Warren Buffett made investments in the shares of Japan’s five major trading companies (Mitsubishi Corp., Mitsui & Co., Itochu Corp., Marubeni Corp., Sumitomo Corp.) in 2020, and in April 2023, he added to those investments.

The American investment media has been reporting consecutively, stating, “Buffett increases investments in Japan, other investors follow suit!” This has brought significant attention to the Japanese stock market.

It remains to be seen whether Warren Buffett will continue to increase his holdings in Japanese stocks or diversify his portfolio in the future.

Keep an eye on how his actions might influence the dynamics of the Japanese stock market.

【Japanese Stock Sector Rotation | Leveraging the 7 Advantages of Investing in Japanese Stocks】

In the stock market, there are sectors that exhibit high performance in different phases, aligning with the trends in the economy and interest rates.

Sector rotation investing involves capitalizing on these sectoral shifts in the stock market.

Key moments for sector rotation occur when the economy and interest rates are in motion.

As of my predictions for the first half of 2024, I anticipate a recovery in the Japanese economy, creating a low-interest-rate investment environment.

Utilizing the Japanese stock version of sector rotation can be a strategic approach.

Leverage the 7 advantages of investing in Japanese stocks, and position yourself in sectors where high performance is expected.

Let’s navigate the opportunities presented by the Japanese stock market and make strategic investments based on sector rotation principles.

Please find Japanese Stock Sector Rotation at this link.

【Summary】

In this article, we have discussed 7 advantages of investing in Japanese stocks.

The Japanese stock market in 2024 presents an exceptionally favorable investment environment in terms of technical aspects, interest rates, foreign exchange, and corporate performance.

Just like in fishing, it’s not enjoyable unless you fish where the catch is plentiful.

Similarly, in stock investing, it’s not as interesting unless you invest where there’s potential for profit.

I hope that 2024 becomes a rewarding year for everyone engaged in Japanese stock investments.

JAPAN COMPANY HANDBOOK

(JCH) is a widely-acclaimed quarterly publication on Japan’s leading companies, provides a brief history, background information, a performance outlook and latest financial data on each of companies listed on all of Japanese stock exchanges.

This edition covers 3,933 companies’ earnings forecasts revised until December 12,2023.