Hello, I’m Torkey, and I invest in stocks as a hobby.

In this blog post, I’ll delve into the details of the market cycle, specifically focusing on the “performance market” and the “financial market” using sector rotation.

By the end of this article, you’ll be equipped to identify favorable investment opportunities based on the market cycle. Please read on.

【Let’s Start with an Explanation of Sector Rotation】

Before we dive into the market cycle, let’s first understand sector rotation.

Sector rotation is an investment strategy that involves shifting investment focus to sectors that are advantageous based on the economic cycle.

The economy goes through cycles such as recovery, prosperity, recession, and downturn.

In stock investment, certain sectors tend to perform well in sync with these economic waves.

Understanding sector rotation helps ride the waves of opportunities.

【Sector Rotation and the Market Cycle】

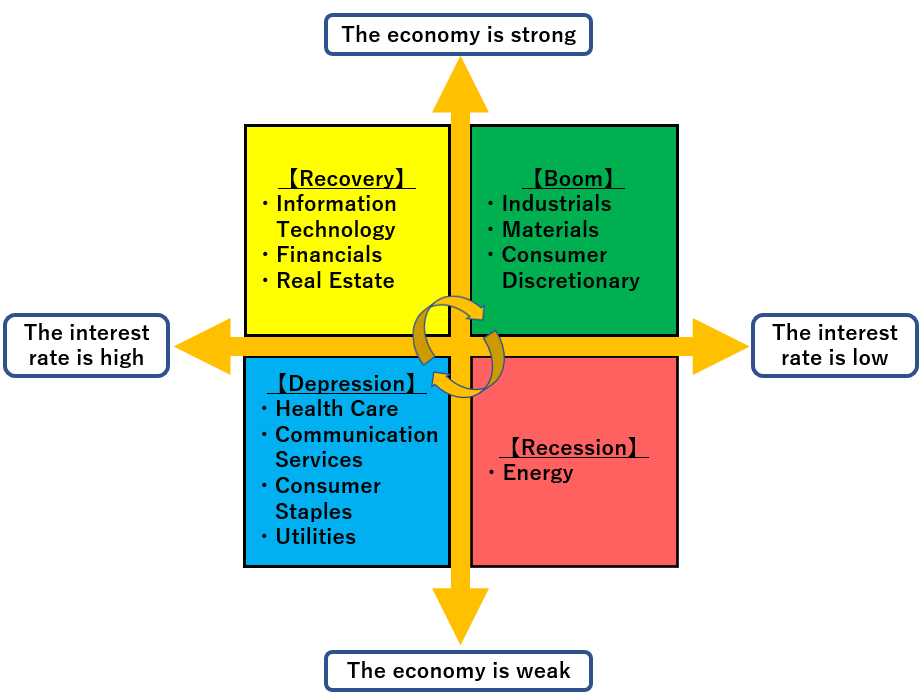

In sector rotation, the economic cycle is often represented as “Recovery Phase → Boom Phase → Recession Phase → Depression Phase → Recovery Phaserecovery …”.

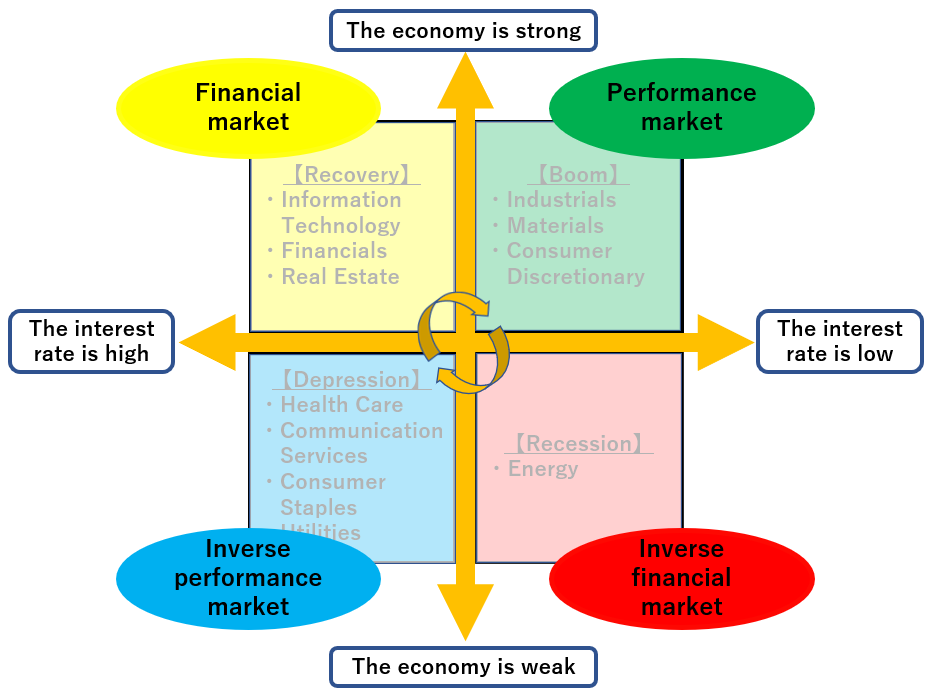

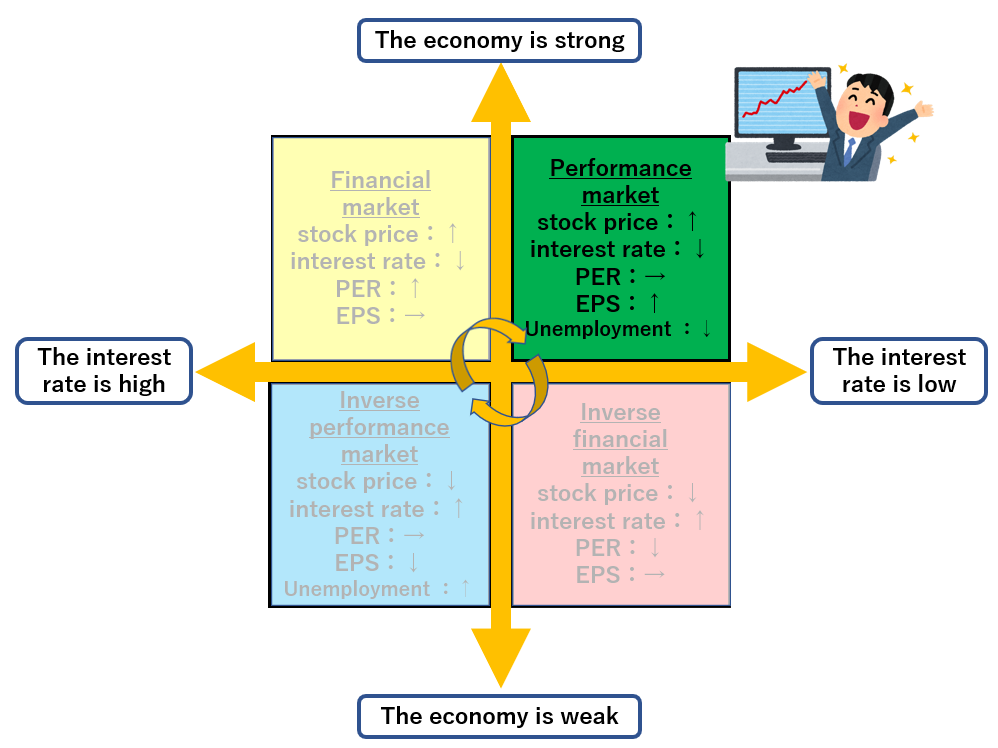

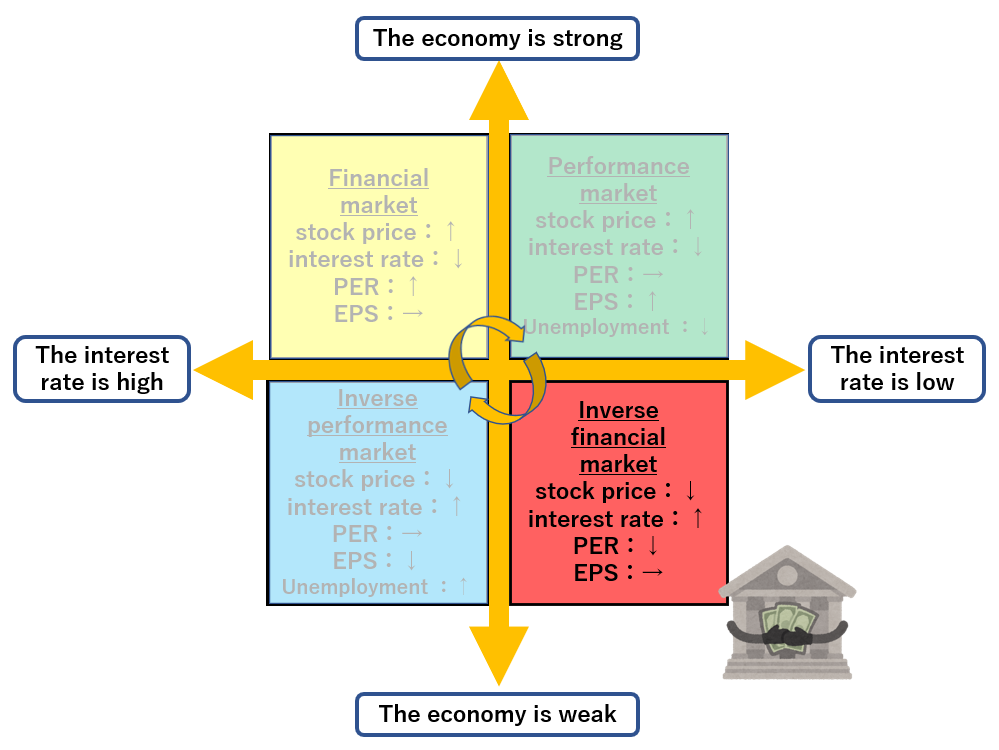

In the market cycle, it aligns with the movement of interest rates and performance as “financial market → performance market → inverse financial market → inverse performance market → financial market…”.

The “economy,” “interest rates,” and “performance” are interconnected.

By overlaying sector rotation and the market cycle, it becomes easier to discern “the current phase,” “which indicators to look at,” and “which sectors are advantageous.”

Recovery Phase = financial market

Boom Phase = performance market

Recession Phase = inverse financial market

Depression Phase = inverse performance market

【Characteristics of Each Phase from the Market Cycle】

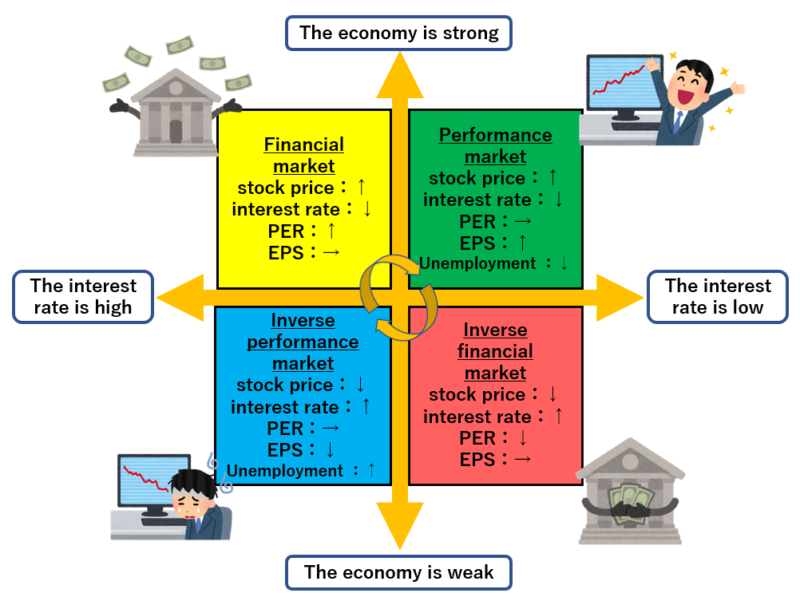

Examining each phase from the market cycle in terms of “stock prices,” “interest rates,” “PER (Price-to-Earnings Ratio),” “EPS (Earnings Per Share),” and “unemployment rate.”

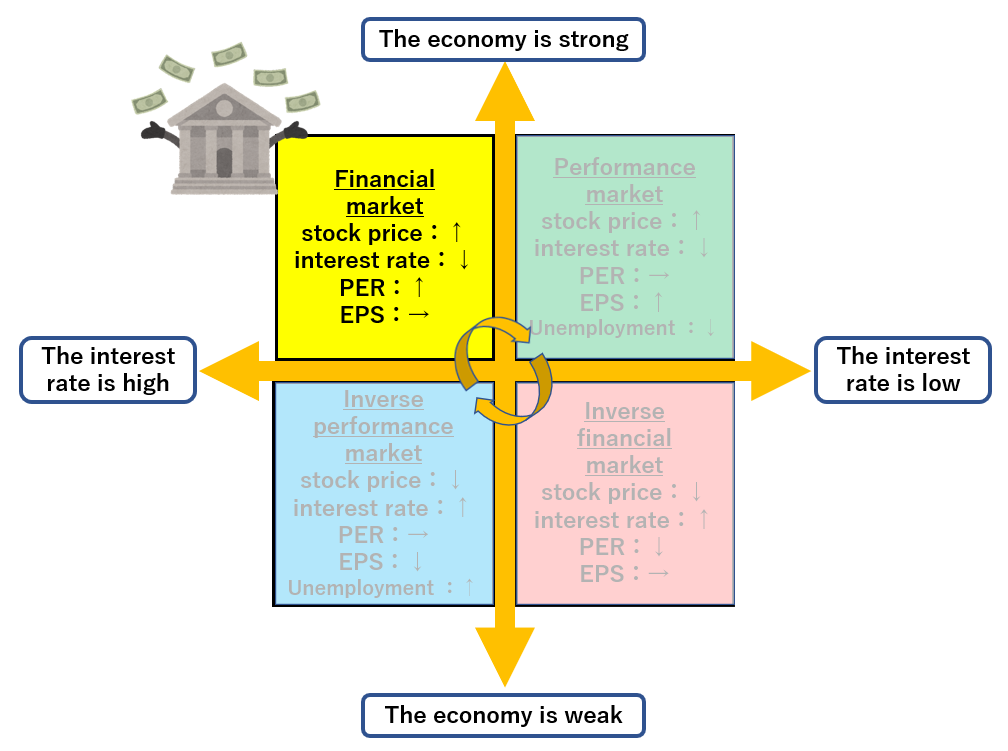

Financial Market = Characteristics of Recovery Phase

The financial market phase in the market cycle corresponds to the economic recovery phase in sector rotation.

During the financial market phase, central banks lower interest rates to stimulate the economy.

With easier access to credit, consumption becomes active, and there is a positive outlook for capital investment and business expansion.

While corporate performance is yet to reflect these changes (EPS →), stock prices tend to rise due to expectations of future economic and performance recovery (PER ↑).

- Growth stocks actively involved in capital investment

- Banking stocks benefiting from lending to companies and individuals Favorable Sectors:

- Information technology, finance, real estate

Performance Market = Characteristics of Boom Phase

The performance market phase in the market cycle aligns with the economic prosperity phase in sector rotation.

In the performance market, low interest rates facilitate corporate growth.

Companies actively expand their operations, leading to a favorable employment environment (unemployment rate ↓) and improved corporate performance (EPS ↑), resulting in a general rise in stock prices.

- Companies showing strong performance

- Newly listed stocks (IPO stocks) Favorable Sectors:

- Capital goods, materials, consumer goods

Inverse Financial Market = Characteristics of Recession Phase

The inverse financial market phase in the market cycle corresponds to the economic downturn phase in sector rotation.

In an inverse financial market, the economy may be overheated, leading to excessive inflation.

Central banks respond by raising interest rates, making borrowing more challenging and suppressing consumption.

While corporate performance is yet to reflect these changes (EPS →), predictions of future economic and performance decline (PER ↓) make stock prices more likely to decrease.

- Value stocks with strong financial health (high dividend stocks)

- Energy-related stocks Favorable Sectors:

- Energy

Inverse Performance Market = Characteristics of Depression Phase

The inverse performance market phase in the market cycle corresponds to the economic recession phase in sector rotation.

In an inverse performance market, high-interest rates act as headwinds, leading to a decline in corporate performance.

Companies scale back operations, leading to a deteriorating employment environment (unemployment rate ↑), and worsening corporate performance (EPS ↓), resulting in a general decline in stock prices.

- Defensive sectors Favorable Sectors:

- Healthcare, communication, essential goods, public utilities

【Summary】

We’ve covered sector rotation and the market cycle.

By understanding the current favorable sectors and those likely to become advantageous, you can enhance your enjoyment of stock investment.

Utilize the market cycle in your stock investment journey.