Hello, I’m Torkey, and I invest in stocks as a hobby.

In this article, I will provide a detailed explanation of the widely used sector rotation strategy in U.S. stock investment.

- 【U.S. Stock Sector Rotation】

- 【U.S. Stock Sector ETFs | Vanguard and State Street】

- 【U.S. Stock Sector Rotation and Advantageous Sectors in Each Economic Phase】

- 【Finviz’s S&P500 Heatmap for U.S. Stock】

- 【Diving Deeper into Sector Rotation | Explaining Market Cycles】

- 【Utilizing Sector Rotation Investment for Portfolio Construction】

- 【Summary】

【U.S. Stock Sector Rotation】

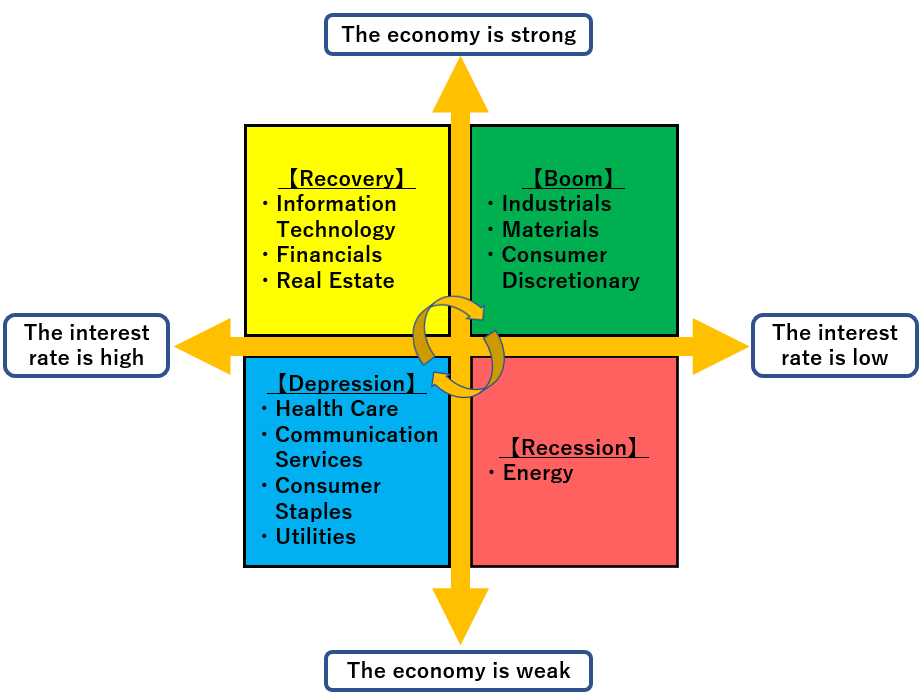

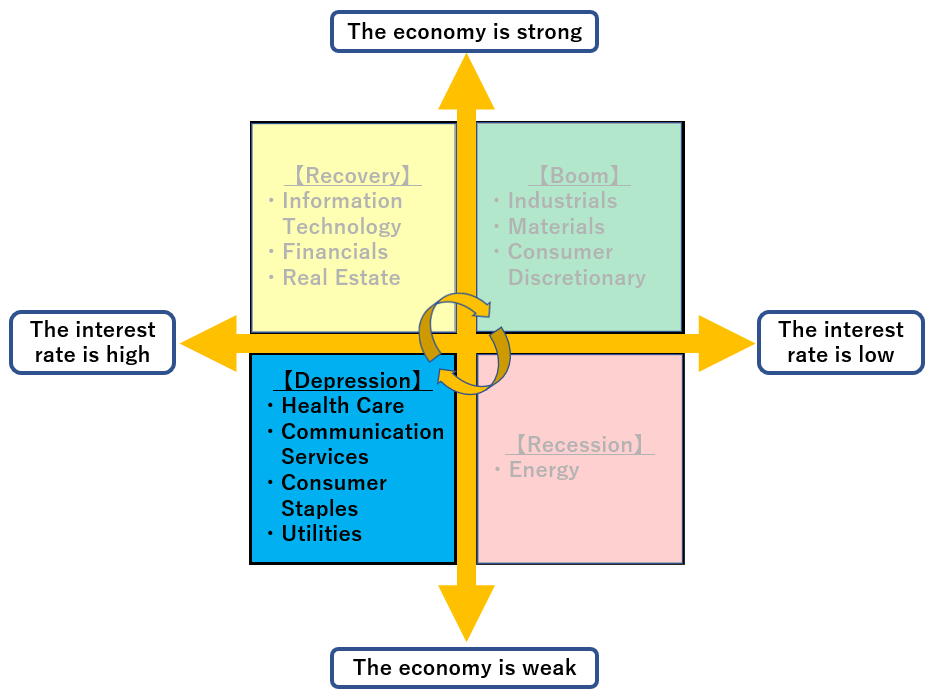

Sector rotation investment involves strategically shifting investment focus to sectors advantageous in different economic phases.

The economic cycle typically moves through Recovery Phase → Boom Phase → Recession Phase → Depression Phase → Recovery Phase, and specific sectors tend to perform well during each phase.

Recognizing sector rotation patterns can enhance your ability to capitalize on market opportunities.

As there are ETFs available for each sector, considering them as investment options is recommended.

【U.S. Stock Sector ETFs | Vanguard and State Street】

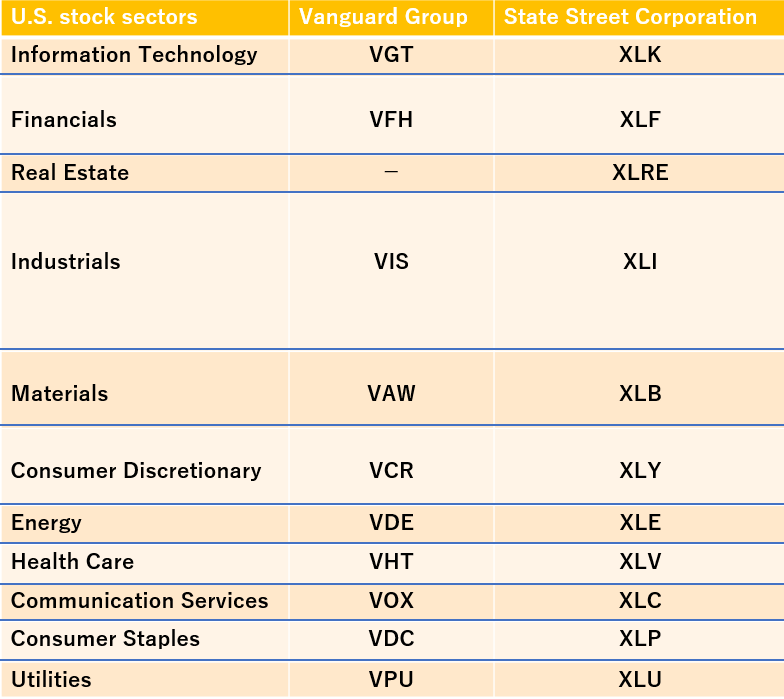

U.S. stocks are divided into 11 sectors, each with corresponding ETFs.

The main companies offering sector ETFs are Vanguard and State Street. For real estate ETFs, State Street is recommended, as Vanguard does not offer them.

【U.S. Stock Sector Rotation and Advantageous Sectors in Each Economic Phase】

In sector rotation investment, selecting investment targets based on economic trends involves checking the characteristics of each economic phase, advantageous sectors, specific sub-genres within sectors, and corresponding sector ETFs.

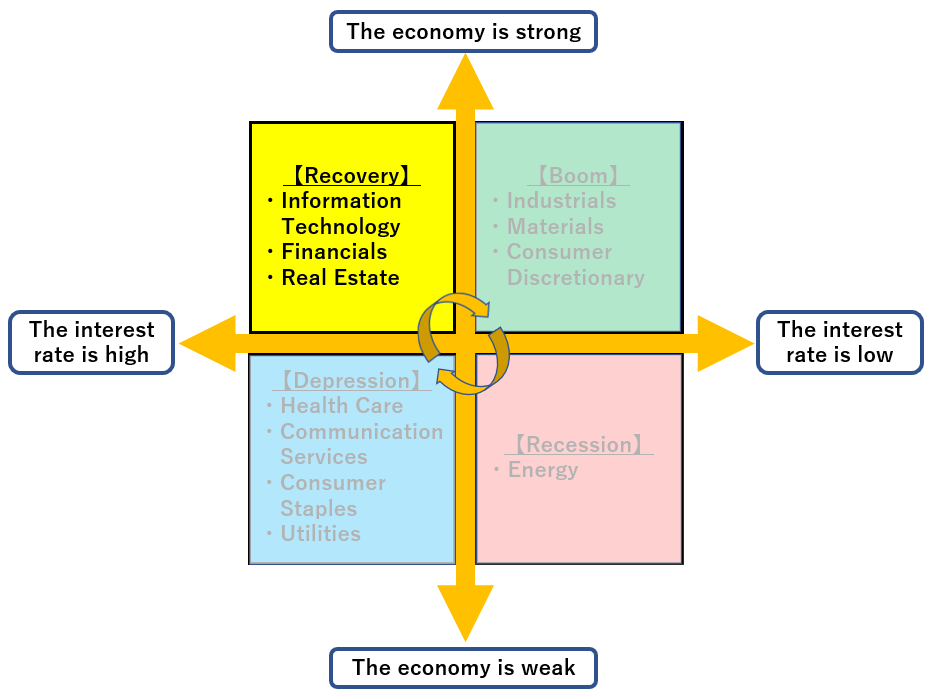

Advantageous Sectors in the Recovery Phase

The recovery phase is a period where the real economy is still under a recession.

Supported by the central bank’s monetary easing, the economy begins to recover from the downturn.

In this context, sector rotation involves a gradual improvement in economic conditions, accompanied by a decrease in interest rates.

During the economic recovery phase, sectors that tend to perform well include Information Technology, Financials, and Real Estate.

Advantageous Sectors in the Boom Phase

During an economic upturn, characterized by monetary easing stimulating corporate growth and increased consumer activity, the real economy experiences a phase of robust activity.

In this context, sector rotation involves a positive economic trend, with interest rates gradually trending upward.

Sectors that tend to thrive during a Boom phase include “Capital Goods,” “Materials,” and “Consumer Discretionary.”

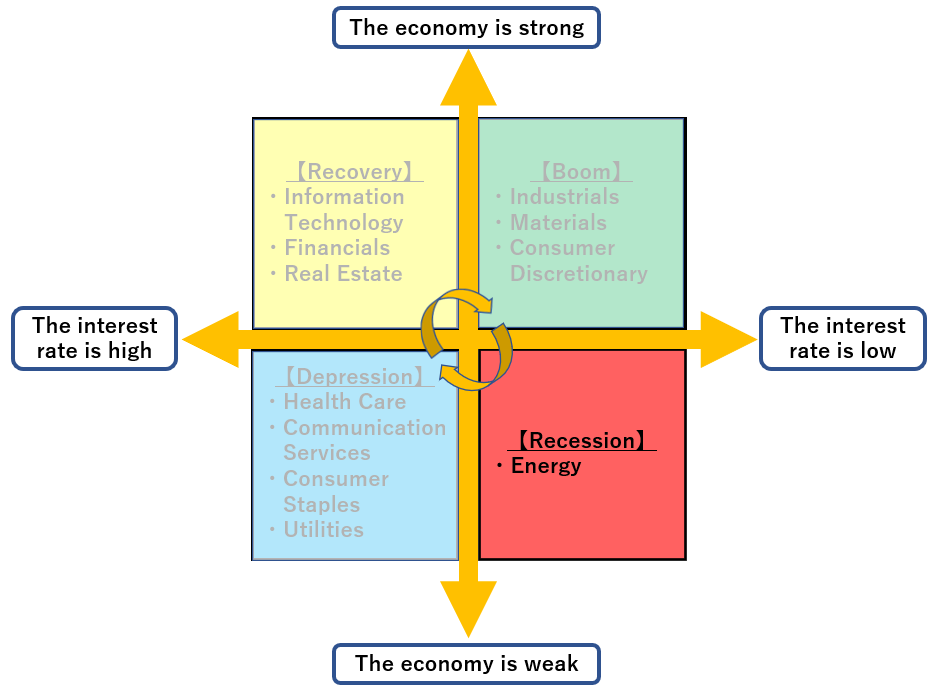

Advantageous Sectors in the Recession Phase

During an economic downturn, there is a tendency for the economy to overheat, leading to excessive inflation.

To maintain economic stability, central banks implement monetary tightening measures, applying brakes to an overheated economy.

In this context, sector rotation involves a gradual economic downturn with interest rates trending upward.

The sector that tends to thrive during a Recession Phase is the “Energy” sector.

Advantageous Sectors in the Depression Phase

During an economic downturn, characterized by monetary tightening leading to a slowdown in corporate growth and restrained consumer spending, the real economy enters a phase of stagnation.

In this context, sector rotation involves a downward economic trend, accompanied by declining interest rates.

Sectors that tend to thrive during a Depression Phase include “Healthcare,” “Communication,” “Consumer Staples,” and “Utilities.”

【Finviz’s S&P500 Heatmap for U.S. Stock】

The above chart is a map of the S&P500 from Finviz.

It is segmented by sector, with each square representing different companies based on their market capitalization.

The color scheme is as follows: green denotes stock price increases (+), red represents stock price decreases (-), and black indicates minimal stock price movement.

This site is highly useful for gaining a quick overview of the overall picture of the U.S. stock market, allowing for easy comprehension at a glance.

【Diving Deeper into Sector Rotation | Explaining Market Cycles】

Understanding sector rotation is just the first step! Let’s delve even deeper into the market cycle.

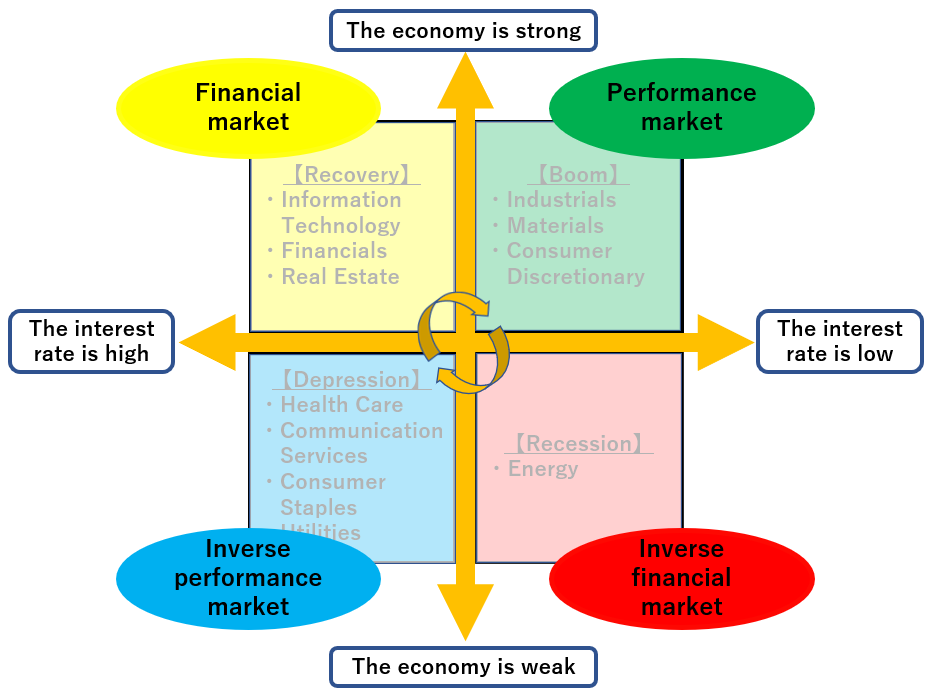

In sector rotation, the economic movement is represented as “Recovery Phase → Boom Phase → Recession Phase → Depression Phase → Recovery Phase…” aligned with the economic cycle.

In the market cycle, movements in interest rates and performance align with “Financial market → Performance market → Inverse financial market → Inverse performance market → Financial market…”

“Economic conditions” and “interest rates/performance” are interconnected.

Therefore, overlaying sector rotation and the market cycle allows for a clearer understanding of the current phase, which indicators to consider, and which sectors are advantageous.

【Utilizing Sector Rotation Investment for Portfolio Construction】

Sector rotation is a valuable indicator for all investors.

For short-term investors, it provides clues about sectors with high current or future performance expectations.

Long-term investors can identify undervalued value stocks.

Understanding sector rotation can enhance stock investment strategies.

【Summary】

This article has provided a comprehensive guide to U.S. stock sector rotation.

Key takeaways include the 11 sectors of U.S. stocks, the cyclical nature of the economy influenced by both economic and interest rate trends, the presence of advantageous sectors in each economic phase, and the intersection of sector rotation and market cycles.

Harness the power of U.S. stock sector rotation to make your stock investments more enjoyable!