Hello, I’m Torkey, and I invest in Japanese stocks as a hobby.

This article will provide an explanation of the Japanese stock sector rotation.

- 【First, let’s confirm the U.S. stock sector rotation】

- 【Correspondence Table of 11 U.S. Stock Sectors and 17 Japanese Stock Sectors】

- 【Japanese Stock Sector Rotation】

- 【When broken down into details, there are 33 types of Japanese stock sectors】

- 【Sectors Preferred by Foreign Investors in Japanese Stocks】

- 【7 advantages of Investing in Japanese Stocks】

- 【Summary】

【First, let’s confirm the U.S. stock sector rotation】

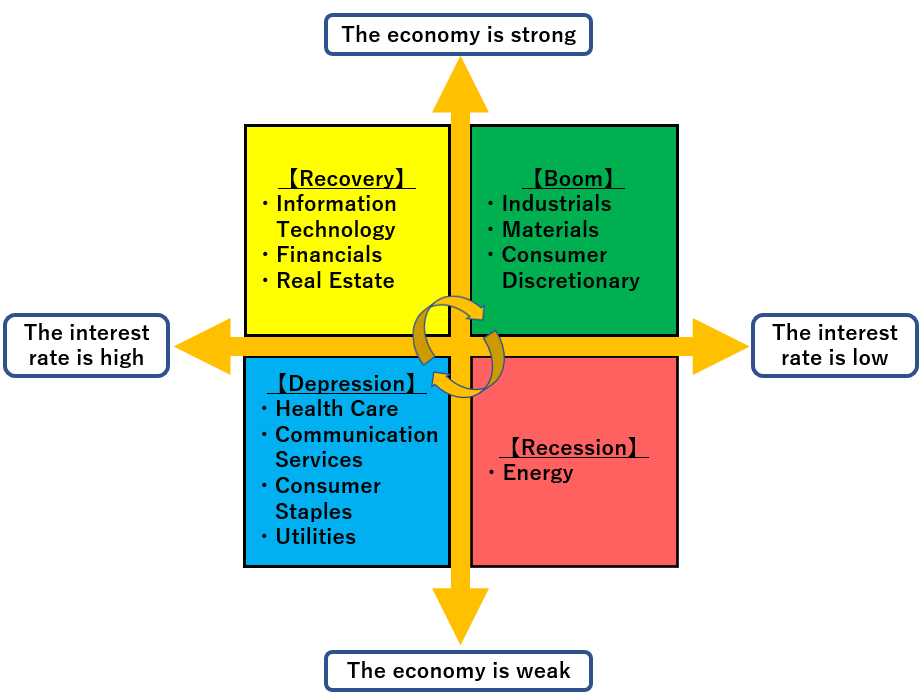

Sector rotation is an investment strategy that involves switching investment focus to favorable sectors in line with economic trends.

The economic cycle typically moves through Recovery Phase → Boom Phase → Recession Phase → Depression Phase → Recovery Phase, and specific sectors tend to perform well during each phase.

By understanding sector rotation, it becomes easier to ride the waves of opportunities.

If you are investing in sector ETFs or individual stocks, it’s advisable to be familiar with sector rotation.

Please find U.S. Stock Sector Rotation at this link.

Please find Economic and Market Cycles at this link.

Please find Performance and Financial Market at this link.

【Correspondence Table of 11 U.S. Stock Sectors and 17 Japanese Stock Sectors】

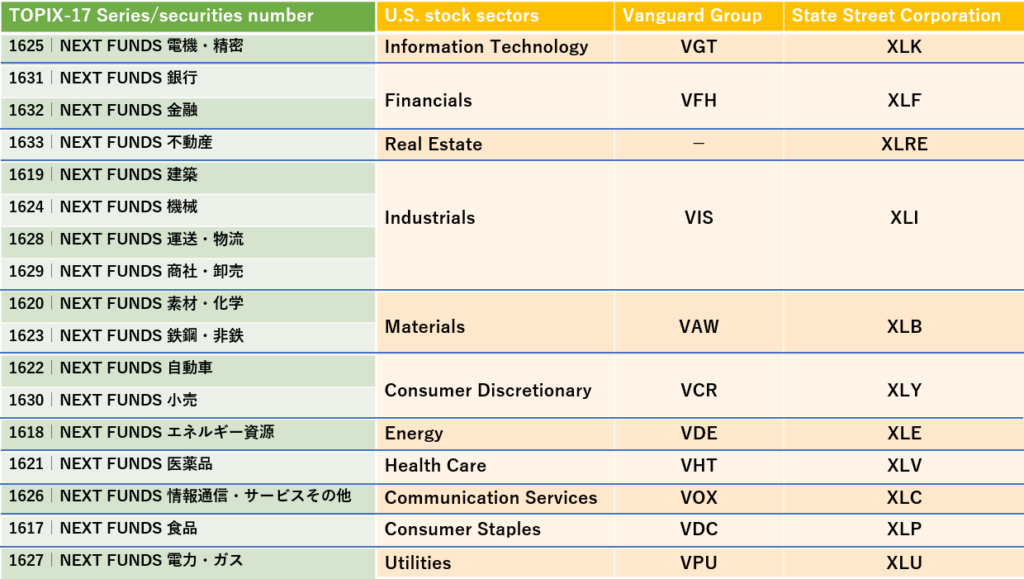

The U.S. stock sectors consist of 11 types: Information Technology, Financials, Real Estate, Capital Goods, Materials, Consumer Discretionary, Energy, Healthcare, Communication Services, Consumer Staples, and Utilities.

The Japanese stock sectors consist of 17 types: Electrical Machinery, Banks, Financials, Real Estate, Construction, Machinery, Transportation and Logistics, Trading and Wholesale, Materials and Chemicals, Iron and Steel/Nonferrous Metals, Automobiles, Retail, Energy Resources, Pharmaceuticals, Information and Communication, Food, Power and Gas.

Please refer to the table correlating the 11 U.S. stock sectors with the 17 Japanese stock sectors that we have created.

To make it more applicable to stock investments, we have also created a correlation table for U.S. stock sector ETFs (Vanguard and State Street ETFs) and Japanese stock sector ETFs (NEXT FUNDS TOPIX-17). Please refer to it.

From the comparison table of 11 types of U.S. stock sectors and 17 types of Japanese stock sectors, we will create a Japanese version of the sector rotation.

【Japanese Stock Sector Rotation】

With reference to the U.S. Stock Sector Rotation, we have created the ‘Japanese Stock Sector Rotation.’

We hope you find it useful as a reference for sector investments in the Japanese stock market.

【When broken down into details, there are 33 types of Japanese stock sectors】

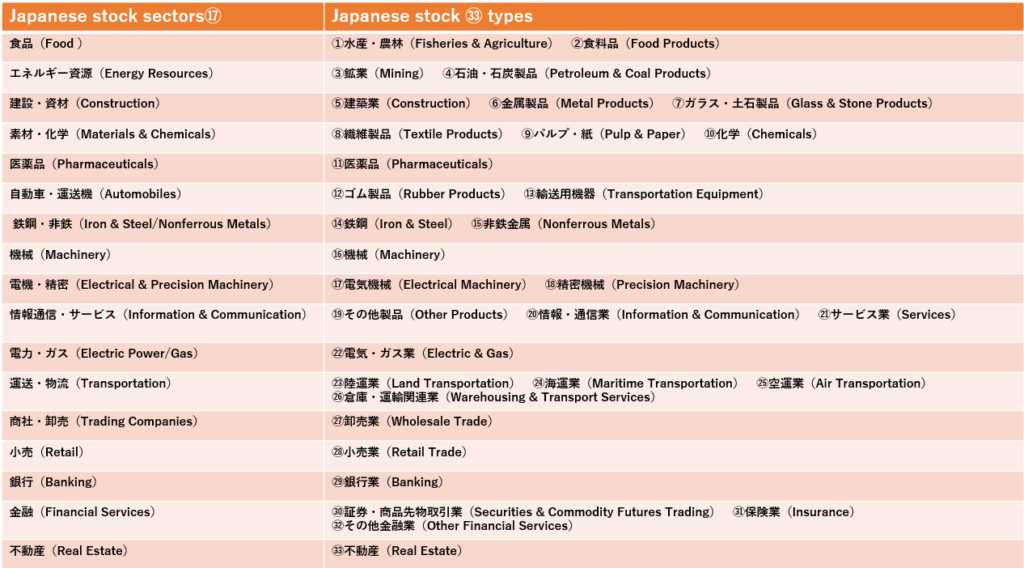

While there are 17 primary sectors in the Japanese stock market, when further classified, they are divided into 33 categories.

Individual stocks in Japan are categorized into these 33 sectors.

When utilizing Japanese stock sector rotation, please refer to both the 17 primary sectors and the detailed breakdown of 33 sectors.

Knowing the sector of the specific stock you have chosen allows you to apply it to sector rotation effectively.

【Sectors Preferred by Foreign Investors in Japanese Stocks】

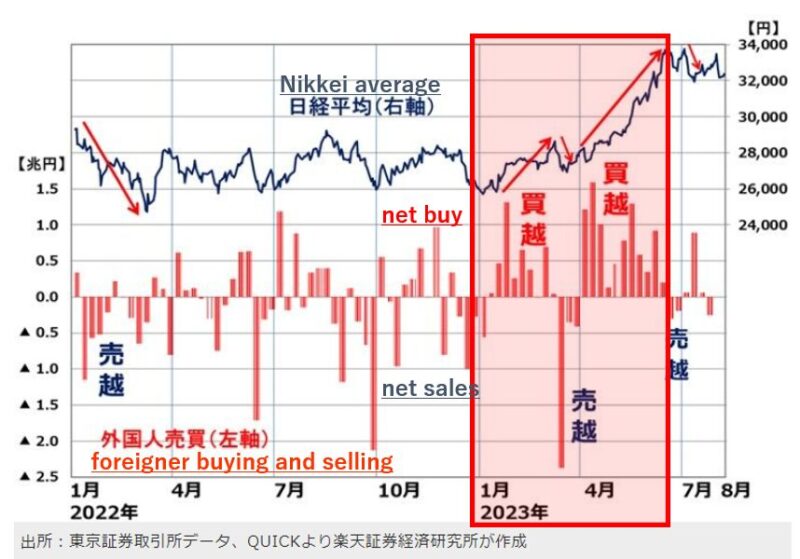

Foreign investors play a significant role in influencing the Japanese stock market.

Over the past 30 years, the trend in the Nikkei Stock Average has shown that when foreign investors buy, stock prices tend to rise, and when they sell, prices decline.

The recent increase in the Nikkei Stock Average from January to July 2023 was attributed to the buying activity of foreign investors.

In other words, being aware of the Japanese stock sectors favored by foreign investors can lead to significant upward movements in stock prices when opportunities arise.

Foreign investors tend to have a high ownership ratio in sectors where Japan maintains international competitiveness.

According to the Tokyo Stock Exchange’s ‘Stock Distribution Survey’ data as of the end of 2021, the sectors with high foreign ownership ratios (based on value) were Precision Instruments: 44.6%, Electrical Equipment: 41.0%, Pharmaceuticals: 40.1%, Other Products (mainly Nintendo): 37.7%, Machinery: 35.4%, Insurance: 34.0%, and Chemicals: 32.8%, in that order.

The average ownership ratio across all industries was 30.4%. Among the 33 industries listed on the Tokyo Stock Exchange, these seven sectors exceeded the average ownership ratio.

According to Bloomberg, in 2023, sectors favored by foreign investors included “Semiconductors,” “Automobile Manufacturers,” and “Trading Companies,” while the sector that faced disfavor was “Pharmaceuticals.”

Semiconductors saw increased expectations due to the Japanese government budgeting for capacity expansion domestically, raising hopes for a recovery in the semiconductor market.

In the automobile sector, Toyota Motor is expected to achieve its highest operating profit for the current fiscal year (ending March 2024) amid a weaker yen.

Trading companies experienced at least a 35% increase since April, following reports of Warren Buffett increasing his holdings.

On the other hand, the pharmaceutical sector recorded the only decline among the 33 sectors in Japan, attributed to a series of failures in clinical trials.

【7 advantages of Investing in Japanese Stocks】

As of the end of December 2023, Japanese stocks have reached a high not seen since the burst of the economic bubble in March 1990, marking a 33-year high.

The Nikkei Stock Average has surged by 28% over the course of 2023, making it one of the leading performers globally.

Based on my research, I predict that the Japanese stock market in 2024 will present a highly favorable investment environment from a technical, interest rate, exchange rate, and corporate performance standpoint.

Why Japanese Stocks are Attractive for Investment Now?

Please find 7 Advantages of Investing in Japanese Stocks at this link.

【Summary】

To encounter numerous investment opportunities, it is crucial to approach stock investments from various perspectives.

In addition to conventional methods such as fundamental analysis and chart analysis, incorporating ‘sector analysis’ as another viewpoint into your stock investment strategy can be valuable.

I would be delighted if it proves beneficial to your stock investments!

JAPAN COMPANY HANDBOOK

(JCH) is a widely-acclaimed quarterly publication on Japan’s leading companies, provides a brief history, background information, a performance outlook and latest financial data on each of companies listed on all of Japanese stock exchanges.

This edition covers 3,933 companies’ earnings forecasts revised until December 12,2023.